Council Meeting

Wednesday, 16 March 2022 at 6:30pm

Cumberland City Council Chambers

Merrylands Service Centre, 16 Memorial Avenue, Merrylands

Council Meeting

Wednesday, 16 March 2022 at 6:30pm

Cumberland City Council Chambers

Merrylands Service Centre, 16 Memorial Avenue, Merrylands

Councillor Contact Details

|

Granville Ward |

||

|

Clr Steve Christou |

0419 651 187 |

|

|

Clr Ola Hamed |

0405 070 007 |

|

|

Clr Joseph Rahme |

0418 995 471 |

|

|

Greystanes Ward |

||

|

Clr Diane Colman |

0400 279 200 |

Diane.Colman@cumberland.nsw.gov.au |

|

Clr Greg Cummings |

0417 612 717 |

|

|

Clr Eddy Sarkis |

0418 306 918 |

|

|

Regents Park Ward |

||

|

Clr Kun Huang (Deputy Mayor) |

0418 911 774 |

|

|

Clr Sabrin Farooqui |

0487 194 169 |

Sabrin.Farooqui@cumberland.nsw.gov.au |

|

Clr Helen Hughes |

0400 264 534 |

Helen.Hughes@cumberland.nsw.gov.au |

|

South Granville Ward |

||

|

Clr Glenn Elmore |

0418 459 527 |

|

|

Clr Paul Garrard |

0414 504 504 |

|

|

Clr Mohamad Hussein |

0400 281 726 |

Mohamad.Hussein@cumberland.nsw.gov.au |

|

Wentworthville Ward |

||

|

Clr Suman Saha |

0419 546 950 |

|

|

Clr Lisa Lake (Mayor) |

0418 669 681 |

|

|

Clr Michael Zaiter |

0418 432 797 |

|

For information on Council services and facilities please visit www.cumberland.nsw.gov.au

Council Meeting

16 March 2022

1 Opening Prayer / Acknowledgement of Country / National Anthem

2 Notice of Live Streaming of Council meeting

3 Apologies / Requests for Leave of Absence

4 Declarations of Pecuniary & Non Pecuniary Conflicts of Interest

5 Confirmation of Previous Minutes

C03/22-26 Minutes of the Ordinary Meeting of Council - 02 March 2022........................................... 5

Nil

7 Public Forum / Presentation of Petitions

8 Items Resolved by Exception

C03/22-27 Legal Report............................................ 21

C03/22-28 Annual Disclosure of Interest Returns for Councillors - Post Election........................ 23

C03/22-29 Update on Approved Mayoral Community Fund Applications..................................... 25

Director Community and Organisation Development

C03/22-30 Sponsorship of The Rotary Club of Holroyd's 20th Annual Charity Golf Day.................... 31

Director Finance & Commercial Services

C03/22-31 Investment Report - February 2022........... 47

Director Environment & Planning

C03/22-32 Employment Zones Reform - Recommended Approach for Cumberland City.................. 71

C03/22-33 Infrastructure Contributions Reform - Submission to NSW Government............ 177

C03/22-34 Draft Planning Agreement for 399 Guildford Road, Guildford...................................... 469

Nil

10 Reports of Council Committees

C03/22-35 Audit, Risk and Improvement Committee - Draft Minutes of Meeting Held on 14 February 2022........................................ 497

Nil

Nil

Nil

C03/22-36 Tender Evaluation Report - Auburn Depot Demolition and Construction

Note: Included in Closed Council in accordance with Section 10A(2)(d)(i) of the Local Government Act as the information involves commercial information of a confidential nature that would, if disclosed prejudice the commercial position of the person who supplied it.

16 Close

Council Meeting

16 March 2022

Item No: C03/22-26

Minutes of the Ordinary Meeting of Council - 02 March 2022

Responsible Division: General Manager

Officer: Executive Manager General Manager's Unit

|

That Council confirm the minutes of the Ordinary Meeting of Council held on 02 March 2022

|

Attachments

DOCUMENTS

ASSOCIATED WITH

REPORT C03/22-26

Attachment 1

Draft Minutes - 2 March 2022

16 March 2022

Item No: C03/22-27

Legal Report

Responsible Division: General Manager

Officer: General Counsel

File Number: 2041456

Community Strategic Plan Goal: Transparent and accountable leadership

Summary

This report provides Council with a summary of legal proceedings in which Council is involved.

|

Recommendation:

That the report be received.

|

Report

This report provides Council with a summary of the status of litigation for which Council is a party to. It does not include the following types of legal proceedings:

· Proceedings that are managed by Council’s insurers;

· Local Court proceedings involving an appeal against a parking fine; and

· Proceedings for the recovery of debts where those proceedings are being run by Council’s external debt collection agency.

The report is current to 28 February 2022. It does not capture changes that have occurred between that date and the date the report is considered by Council.

Community Engagement

There are no consultation processes for Council associated with this report.

Policy Implications

There are no policy implications for Council associated with this report.

Risk Implications

There are no risk implications for Council associated with this report.

Financial Implications

There are no financial implications for Council associated with this report.

CONCLUSION

This is an information report with the legal register of current litigation provided as a confidential attachment.

Attachments

Council Meeting

16 March 2022

Item No: C03/22-28

Annual Disclosure of Interest Returns for Councillors - Post Election

Responsible Division: General Manager

Officer: Executive Manager General Manager's Unit

File Number: SC686

Community Strategic Plan Goal: Transparent and accountable leadership

Summary

This report outlines the tabling of Disclosure of Pecuniary Interest Returns lodged by Councillors in accordance with Schedule 1 of the Model Code of Conduct for Local Councils in NSW (the Model Code of Conduct).

|

Recommendation That Council note the tabling of the Annual Disclosure of Interest Returns for all Councillors, noting that returns were lodged within 3 months of the election declaration of results date for each ward. |

Report

Clause 4.21 of Council’s Code of Conduct requires that all Councillors post-election lodge a Disclosures of Interest Return within 3 months of becoming a Councillor as follows:

Disclosure of Interests in Written Returns

4.21 A councillor or designated person must make and lodge with the general

manager a return in the form set out in schedule 2 to this code, disclosing the

councillor’s or designated person’s interests as specified in schedule 1 to this

code within 3 months after:

(a) becoming a councillor or designated person, and

(b) 30 June of each year, and

(c) the councillor or designated person becoming aware of an interest

they are required to disclose under schedule 1 that has not been previously disclosed in a return lodged under paragraphs (a) or (b).

Accordingly, the returns of all newly elected Councillors from the period of the Declaration of Results to the period ending 30 June 2021 are tabled for information.

It is noted that all Councillors and Designated Persons lodged their completed return in the prescribed format by the due date.

Council will also notify the Office of Local Government in relation to all returns being received for the period.

Community Engagement

There are no consultation processes for Council associated with this report.

Policy Implications

There are no policy implications for Council associated with this report.

Risk Implications

By finalising these returns, Council is adhering to its compliance requirements under the Code of Conduct as prescribed under the Local Government Act 1993.

Financial Implications

There are no financial implications for Council associated with this report.

CONCLUSION

The Annual Disclosure of Interest Returns are tabled to Council for information.

Attachments

Nil

Council Meeting

16 March 2022

Item No: C03/22-29

Update on Approved Mayoral Community Fund Applications

Responsible Division: General Manager

Officer: Executive Manager General Manager's Unit

File Number: 8281543

Community Strategic Plan Goal: Transparent and accountable leadership

Summary

This report provides an update on Mayoral Community Fund applications approved since the previous update provided at the 17 November 2021 Council meeting.

|

Recommendation That Council receive the report. |

Report

This report outlines the details of Mayoral Community Fund applications approved since the previous update provided at the 17 November 2021 Ordinary Council Meeting.

Four applications were approved. Details of the approved applications can be reviewed in the attachment provided.

Community Engagement

There are no consultation processes for Council associated with this report.

Policy Implications

The approved applications are in accordance with the Council endorsed Mayoral Community Fund Guidelines.

Risk Implications

There are no risk implications for Council associated with this report.

Financial Implications

The Mayoral Community Fund is budgeted at $30,000 per annum. The current balance of the Mayoral Community Fund following the approved applications being funded is $2,495 for the remainder of the financial year.

CONCLUSION

Mayoral Community Funding was granted to four applicants since the previous update provided at the 17 November 2021 Council meeting. It is recommended that Council receive the report.

Attachments

DOCUMENTS

ASSOCIATED WITH

REPORT C03/22-29

Attachment 1

Approved Mayoral Community Fund Applications

Council Meeting

16 March 2022

Item No: C03/22-30

Sponsorship of The Rotary Club of Holroyd's 20th Annual Charity Golf Day

Responsible Division: Community and Organisation Development

Officer: Director Community and Organisation Development (Deputy GM)

File Number: SC586

Community Strategic Plan Goal: A great place to live

Summary

The Rotary Club of Holroyd will host its 20th Annual Charity Golf Day on 1 April 2022 to raise funds for Blaze Aid. This report recommends sponsoring the charity event in support of the work undertaken by these groups.

|

Recommendation That Council Sponsor the Rotary Club of Holroyd’s 20th Annual Charity Golf Day event for an amount of $750. |

Report

The Rotary Club of Holroyd will host its 20th Annual Charity Golf Day on 1 April 2022, at the Cumberland Golf Club, Greystanes.

This year, The Rotary Club of Holroyd will raise funds in support of Blaze Aid, a volunteer-based organisation which assists rural families and individuals who have been impacted in some way by a natural disaster.

A small group of Holroyd Rotarians spent five days visiting the south coast areas of NSW, meeting local farmers and towns people and small business owners and heard first-hand their stories of hardship as a result of the severe fires there over Christmas/January 2019/2020. Some farmers lost everything, including their homes, and local business suffered significantly because people were not visiting the area for holidays or purchasing the goods produced in the region. The impacts of this natural disaster have been felt for long after it occurred and Holroyd Rotary is working to assist Blaze Aid with their re-building efforts in this region.

It is recommended that Council sponsor this event by contributing an amount of $750 which is equivalent to a Tee and Green Sponsor as per the Club’s Sponsorship Package Guidelines, which is provided under Attachment 1 of this report. The Mayor has accepted an invitation to the event luncheon.

Community Engagement

There are no consultation processes for Council associated with this report.

Policy Implications

This report has been prepared in accordance with Council’s Sponsorship Policy (Attachment 2).

Risk Implications

There are no risk implications for Council associated with this report.

Financial Implications

Funding is available from Council’s Events Administration budget to pay for the $750 sponsorship payment.

CONCLUSION

It is recommended that Council sponsor the Rotary Club of Holroyd’s 20th Annual Charity Golf Day for an amount of $750 as per Council’s Sponsorship Policy. The Rotary Club of Holroyd will contribute funds raised at this year’s event to Blaze Aid, a volunteer-based organisation which assists rural families and individuals who have been impacted in some way by a natural disaster.

Attachments

DOCUMENTS

ASSOCIATED WITH

REPORT C03/22-30

Attachment 1

Rotary Club of Holroyd Sponsorship Package Guidelines

16 March 2022

Item No: C03/22-31

Investment Report - February 2022

Responsible Division: Finance & Commercial Services

Officer: Director Finance and Commercial Services

File Number: A-05-01/05

Community Strategic Plan Goal: Transparent and accountable leadership

Summary

This is a report from the CFO providing an update on the performance and compliance of Council’s investment portfolio for the month of February 2022.

|

Recommendation:

That Council receive the February 2022 Investment Report. |

Report

Included in this report are the following items that highlight Council’s investment portfolio performance for February 2022.

Council Investments as at 28 February 2022

Council’s investment portfolio has a current market value of $188.9m and has returned 0.81% in the last 12 months.

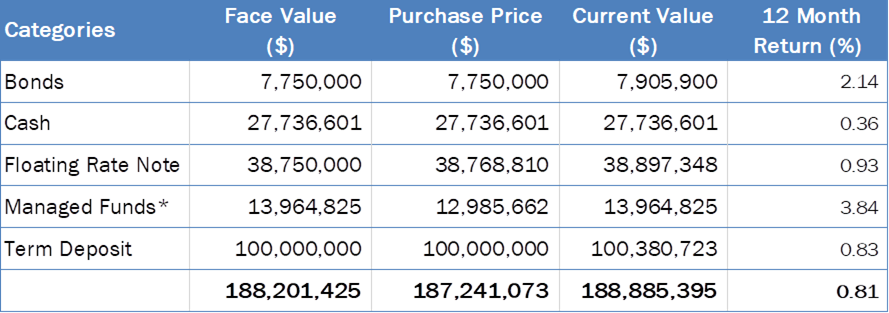

The following table reflects Council’s holding in various investment categories:

Face Value = capital value to be repaid upon maturity

Purchase Price = capital value +/- premiums or discounts

Current Value = current market value + accrued interest

Investment Portfolio Performance

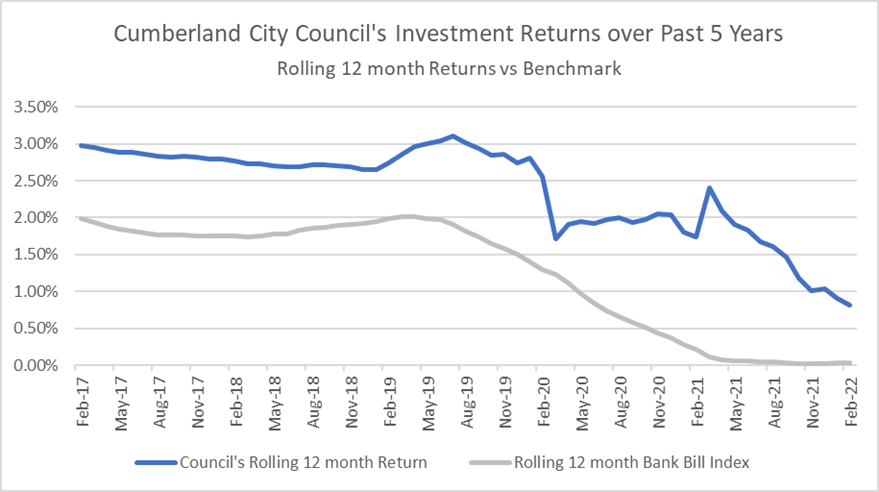

Council’s investment portfolio returned -1.32%pa for the month of February versus the bank bill index benchmark return of 0.07%pa. This monthly result was predominantly driven by the financial markets factoring in future interest rate rises which impacted Council’s managed funds investments. Council’s managed funds investments will experience monthly volatility as financial markets change their outlook but provide a favourable return as a long term investment. For the past 12 months, the investment portfolio has returned 0.81%pa, exceeding the bank bill index benchmark’s 0.03%pa by 0.78%pa.

As was the case in January, the portfolio’s overall return was impacted by rising interest rates causing marked-to-market declines in current bond valuations and the performance of the NSW TCorpIM Medium Term Growth Fund, which also reflected the volatility in the global share markets, with a result of -1.82% (actual).

As at 28 February 2022 the cumulative interest earned was 803k. This is 230k lower than the year-to-date budget of 1.03m.

The performance chart below shows Council’s rolling 12 monthly return versus benchmark over the past 5 years. Each data point is the 12 month return for the stated month end:

Council’s investment performance has reflected the downward trend in interest rate markets over recent years accelerated by pandemic related interest rate cuts, but the portfolio has maintained returns in excess of the industry benchmark. With inflation pressures beginning to build, interest rates appear to have levelled off and are beginning to show signs of increasing again.

Community Engagement

There are no consultation processes for Council associated with this report.

Policy Implications

There are no policy implications for Council associated with this report.

Risk Implications

Preservation of capital is the prime objective of the investment portfolio. Investments are placed in a manner that seeks to ensure security and safeguarding of the investment portfolio. This includes managing credit and interest rate risk within identified thresholds and parameters that is both set in Councils Investment Policy and guided by the investment advisor.

The investing of Council’s funds at the most favourable return available to it at the time whilst having due consideration of risk and security for that investment type and ensuring that its liquidity requirements are being met while exercising the power to invest, consideration is to be given to the preservation of capital, liquidity, and the return on investment.

Financial Implications

There are no financial implications for Council associated with this report.

CONCLUSION

Council hereby certifies that the investments listed within this report have been made in accordance with Section 625 of the Local Government Act 1993, Clause 212 of the Local Government (General) Regulation 2005 and Council’s Investment Policy.

Attachments

1. Investment Summary Report February 2022

DOCUMENTS

ASSOCIATED WITH

REPORT C03/22-31

Attachment 1

Investment Summary Report February 2022

16 March 2022

Item No: C03/22-32

Employment Zones Reform - Recommended Approach for Cumberland City

Responsible Division: Environment & Planning

Officer: Director Environment & Planning

File Number: CS-247

Community Strategic Plan Goal: A resilient built environment

Summary

The NSW Government is undertaking employment zones reform aimed at supporting the State’s recovery from the COVID-19 pandemic. These reforms are intended to increase flexibility for business by replacing the existing 12 business and industrial zones with five new employment zones and three supporting zones.

The employment zones reform initiated by the NSW Government requires an amendment to the Cumberland LEP, which is to be finalised by the end of 2022. This amendment will transition relevant lands in the Cumberland LEP to new employment zone classifications, with some changes to land use tables and affected clauses. This work is being led by the Department of Planning and Environment, with review and input from Council officers.

It is recommended that Council endorse the proposed translation of planning provisions under the employment zones reform. Endorsement is required by Council no later than the end of March 2022 to enable public exhibition of the changes by the Department of Planning and Environment in April 2022.

|

Recommendation That Council: 1. Note the status of the employment zones reform and the role of the Department of Planning and Environment in coordinating these reforms. 2. Endorse the proposed translation changes on employment zones for the Cumberland Local Environmental Plan, as outlined in this report and Attachments 1 to 4. 3. Note that a public exhibition process will be led by the Department of Planning and Environment on the employment zone reforms. |

Report

Background

The new employment zones framework is part of the NSW Government’s recent suite of planning reforms aimed at supporting the State’s recovery from the COVID-19 pandemic. The reforms are intended to increase flexibility for business by replacing the existing 12 business and industrial zones with five new employment zones and three supporting zones. Details of the changes to employment zones is provided in Table 1. It is noted that a reference to an Environment Protection zone E1, E2, E3 or E4 should be taken to be a reference to a Conservation zone C1, C2, C3 or C4. This was included in the Cumberland LEP instrument, with mapping to be updated by the end of 2022.

|

EXISTING ZONE |

NEW EMPLOYMENT ZONE |

|

B1 Neighbourhood Centre |

E1 Local Centre |

|

B2 Local Centre |

|

|

B3 Commercial Core* |

E2 Commercial Centre |

|

B5 Business Development |

E3 Productivity Support |

|

B6 Enterprise Corridor |

|

|

B7 Business Park* |

|

|

IN1 General Industrial |

E4 General Industrial |

|

IN2 Light Industrial |

|

|

IN3 Heavy Industrial* |

E5 Heavy Industrial |

|

B4 Mixed Use |

MU1 Mixed Use |

|

IN4 Working Waterfront* |

W4 Working Waterfront |

|

B8 Metropolitan Centre* |

SP4 Enterprise |

*These zones are not currently used in the CLEP 2021

Table 1: Existing and New Employment Zones

Implementation of the new framework will require an amendment to the Cumberland LEP to transition the existing business and industrial zones into the new employment zones. The amendment is being coordinated by the Department of Planning and Environment, including the preparation of translation details for review by Council, consideration of feedback from Council by the Department, State-wide exhibition and finalisation of the reform. The reform will need to be implemented by the end of 2022.

Approach

In November 2021, the Department of Planning and Environment issued all Councils with the proposed translation changes for the employment zones into their LEPs (known as a ‘Return Translation Detail’). The proposed translations from the Department were based on a ‘like for like’ comparison with the current Cumberland LEP 2021 employment and supporting zones. Council officers were required to review this detail and prepare a draft response to the Department by January 2022, which was undertaken in accordance with the Department’s requirements. The Department has acknowledged the response and that Council endorsement for the exhibition detail will occur in March 2022.

In responding to the proposed translation changes, Council officers undertook a review and analysis with consideration of the following:

· Suitability of zoning in accordance with the centres framework in Cumberland 2030: Our Local Strategic Planning Statement

· Scope and location of existing neighbourhood centres and land uses

· Suitability of land use tables when compared to the current Cumberland LEP

· Identification of business properties in residential zones, as different approach were undertaken by the former Auburn, Holroyd and Parramatta LGAs

· Other amendments required to the Cumberland LEP as a result of the employment zone reforms.

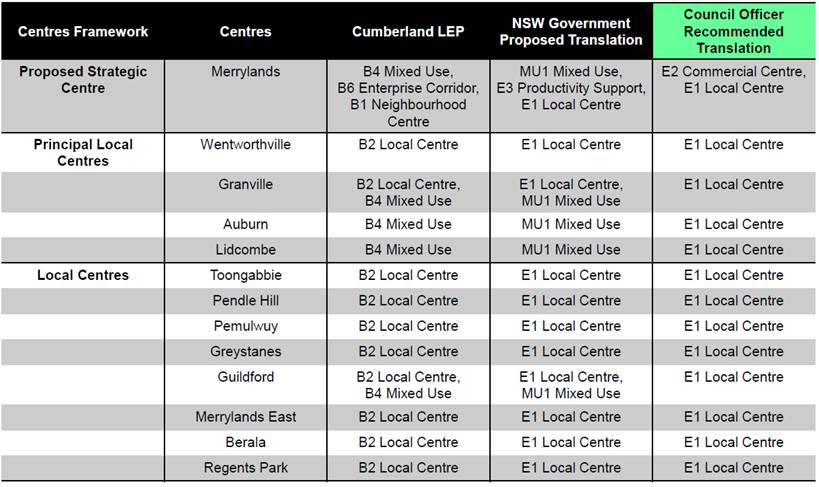

Recommended Translation of Employment Zones

Proposed E1 Local Centre and E2 Commercial Core zones

Using the strategic intent of the proposed E1 Local Centre and E2 Commercial Core zones, an analysis of existing B1 Neighbourhood Centre, B2 Local Centre and B4 Mixed Use zones was undertaken. Based on the analysis, it is proposed that the E1 Local Centre zone is used for existing local and neighbourhood centres. The exception to this is for Merrylands Town Centre, where it is proposed that the E2 Commercial Core and E1 Local Centre zones apply in this area, reflecting the role of Merrylands as the proposed strategic centre for Cumberland City.

As a result of this proposal, changes to the translation of the zoning when compared to the proposed translation by the Department of Planning and Environment arises for some of the local centres, including Auburn, Granville, Guildford, Lidcombe and Merrylands. Further details are provided in Tables 2 and 3, as well as Attachments 1 to 4.

The differences relate to the literal translation of B4 Mixed Use and B6 Enterprise Corridor zones by the Department to MU1 Mixed Use. Council officers believe that the use of E1 Local Centre and E2 Commercial Core better reflect the strategic intent of the centre’s framework in Cumberland 2030: Our Local Strategic Planning Statement, and better aligns with the existing land use tables that apply for these areas. The Department has not objected to the proposed translation identified by Council officers.

Table 2: Comparison of Translation for Centres in Cumberland City

|

CURRENT / PROPOSED ZONING & REASONING |

|

|

Merrylands Town Centre

|

Change in zoning

Lands to the west of the rail line Existing: B4 Mixed Use and B6 Enterprise Corridor lands Proposed: E2 Commercial Centre.

Lands to the east of the rail line Existing: B1 Neighbourhood Centre and B4 Mixed Use lands Proposed: E1 Local Centre.

Reasoning

Applying an E2 Commercial Centre Zone to lands west of the rail line will support Merrylands as a ‘strategic centre’ with a highly complementary and reciprocal relationship to Parramatta CBD (Metropolitan Centre) and is consistent with Council’s Local Strategic Planning Statement as endorsed by the Greater Sydney Commission.

Applying an E1 Local Centre zoning to lands zoned B1 Neighbourhood Centre and B4 Mixed Use is consistent with the Department’s prescribed general zone transitions for B1 zones. The re-classification of B4 Mixed Use to E1 Local Centre is reflective of the existing function and operation of these lands. |

|

Auburn Town Centre

|

Change in zoning

Existing: B4 Mixed Use lands Proposed: E1 Local Centre

Reasoning

The re-classification of B4 Mixed Use to E1 Local Centre is reflective of the existing function and operation of these lands and will improve alignment with both state and local strategic policy objectives. In the new employment zones, the new Mixed Use zoning is for transition areas from centres. Auburn Town Centre is one of Cumberland’s Principal Centres and therefore should be zoned E1 Local Centre. |

|

Granville Town Centre

|

Change in zoning

Existing: B2 Local Centre and B4 Mixed Use lands Proposed: E1 Local Centre

Reasoning

The re-classification of B4 Mixed use lands to the E1 Local Centre zone is reflective of the existing function and operation of these lands as part of the Granville Town Centre. In the new employment zones, the new Mixed Use zoning is for transition areas from centres. Granville Town Centre is one of Cumberland’s Principal Centres and therefore should be zoned E1 Local Centre.

The re-classification of the B2 Local Centre zoned land to E1 Local Centre is consistent with the Department’s prescribed general zone transitions and is consistent with the existing role and function of this part of the Granville Town Centre.

|

|

Lidcombe Town Centre

|

Change in zoning

Existing: B4 Mixed Use lands Proposed: E1 Local Centre

Reasoning

The re-classification of B4 Mixed Use zoned lands to the E1 Local Centre zone is reflective of the existing function and operation of these lands as part of the Lidcombe Town Centre. In the new employment zones, the new Mixed Use zoning is for transition areas from centres. Lidcombe Town Centre is one of Cumberland’s Principal Centres and therefore should be zoned E1 Local Centre.

|

|

Guildford Town Centre

|

Change in zoning

Existing: B2 Local Centre and B4 Mixed Use lands Proposed: E1 Local Centre

Reasoning

The re-classification of B4 Mixed Use lands to the E1 Local Centre zone is reflective of the existing function and operation of these lands as part of the Guilford Town Centre.

The re-classification of the B2 Local Centre zoned land to E1 Local Centre is consistent with the Department’s prescribed general zone transitions and is consistent with the existing role and function of this part of the Guildford Town Centre.

|

Table 3: Reasoning for Local Centre Translation Changes Identified by Council

It is recommended that Council endorse the translation proposed in the Cumberland LEP for the E1 Local Centre and E2 Commercial Core zones.

Proposed E3 Productivity Support zone

Using the strategic intent of the proposed E3 Productivity Support zone, an analysis of existing B5 Business Development, B6 Enterprise Corridor and B7 Business Park zones were undertaken. Based on the analysis, it is proposed that the E3 Productivity Support zone is used for existing business and enterprise areas. The exception to this is for Merrylands Town Centre, where it is proposed that land zoned B6 Enterprise Corridor are zoned as E2 Commercial Core, reflecting the role of Merrylands as the proposed strategic centre for Cumberland City.

As a result of this proposal, changes to the translation of the zoning when compared to the proposed translation by the Department of Planning and Environment only occur for the Merrylands Town Centre as outlined above. Further details are provided in Attachments 1 to 4. The Department has not objected to the proposed translation identified by Council officers.

It is recommended that Council endorse the translation proposed in the Cumberland LEP for the E3 Productivity Support zone.

Proposed E4 General Industrial zone

Using the strategic intent of the proposed E4 General Industrial zone, an analysis of existing IN1 General Industrial and IN2 Light Industrial zones were undertaken. Based on the analysis, it is proposed that the E4 General Industrial zone is used for existing industrial areas. The exception to this is for selected lands on St Hillers Road, Auburn, where it is proposed that land zoned as IN1 General Industrial are zoned E3 Productivity Support, to align with the strategic intent of the Parramatta Road Urban Transformation Strategy. This approach has previously been endorsed by Council.

As a result of this proposal, changes to the translation of the zoning when compared to the proposed translation by the Department of Planning and Environment only occur for the Merrylands Town Centre as outlined above. Further details are provided in Table 4, and Attachments 1 to 4. The Department has not objected to the proposed translation identified by Council officers.

It is recommended that Council endorse the translation proposed in the Cumberland LEP for the E4 General Industrial zone.

|

LOCATION |

CURRENT / PROPOSED ZONING & REASONING |

|

Land at St Hilliers Road, Auburn (bordered by A6, Hall St., Percy St.)

|

Change in zoning

Existing: IN1 General Industrial lands (Lands along the south of St Hilliers Road bordered by A6, Hall St., Percy St.) Proposed: E3 Productivity Support.

Reasoning

Re-classification of the IN1 General Industrial zoned lands adjoining the southern end of St Hilliers Road to E3 Productivity Support will fulfil the recommendations from Parramatta Road Urban Transformation Strategy (PRCUTS), which has been previously endorsed by Council, and improve alignment with both state and local strategic policy objectives. |

Table 4: Reasoning for Industrial Land Translation Changes Identified by Council

Land use tables

Council officers have reviewed the land use tables for the new zones and compared these with the land use tables in the current zones under the Cumberland LEP. In general terms, permitted with consent and prohibited land uses generally align with current land use table for relevant employment zones. However, there are some additional land uses that would be permitted with consent or prohibited under these reforms. A summary of key changes by zone and by the six locations where Council officers have identified a different translation to the Department of Planning and Environment is provided in Tables 5 and 6. Further details are also provided in Attachments 1 to 4.

Through these reforms, the NSW Government has also mandated changes to permissible on places of public worship. Under the Cumberland LEP, places of public worship are only permitted with consent in industrial lands and prohibited in business and enterprise lands. With this translation, places of public worship will be permitted with consent in business and enterprise zones.

|

NEW ZONE |

EXISTING ZONING |

KEY NOTES |

|

E1 Local Centre |

B1 Neighbourhood Centre B2 Local Centre |

- Tourist and visitor accommodation to be permitted with consent where previously prohibited in B1 - Broader range of commercial and retail premises to be permitted with consent where previously prohibited in B1 - Broader range of community facilities (such as schools, child-care, etc.) to be permitted with consent where previously prohibited in B1 - Places of public worship to be permitted with consent where previously prohibited in B1 and B2 (this change is mandated) |

|

E2 Commercial Centre |

*B3 Commercial Core *Not currently used in Cumberland LEP 2021 |

- Tourist and visitor accommodation to be permitted with consent where previously prohibited in B4 and B6 - Places of public worship, Mortuaries, Amusement centres, Artisan food and drink industry, Vehicle repair stations to be permitted with consent where previously prohibited in B4 (these changes are mandated) - Light industries except for Artisan food and drink industry; Home industry to be prohibited where previously permitted with consent in B6. |

|

E3 Productivity Support |

B5 Business Development B6 Enterprise Corridor *B7 Business Park *Not currently used in Cumberland LEP 2021 |

- Broader range of commercial premises to be permitted with consent where previously prohibited in B5/B6 - Broader range of community infrastructure uses to be permitted with consent where previously prohibited in B5/B6 - Places of public worship to be permitted with consent where previously prohibited in B5/B6 (this change is mandated) |

|

E4 General Industrial |

IN1 General Industrial IN2 Light Industrial |

- Broader range of commercial premises to be permitted with consent where previously prohibited in IN1/IN2 - Sex services premises to be permitted with consent where previously prohibited in IN2 |

Table 5: Key Changes in Land Use Tables by New Zones

|

LOCATION |

CHANGE IN ZONING |

KEY NOTES |

|

Merrylands Town Centre |

Lands to the east of the rail line: B1 Neighbourhood Centre and B4 Mixed Use lands become E1 Local Centre.

Lands to the west of the rail line: B4 Mixed Use and B6 Enterprise Corridor lands become E2 Commercial Centre. |

- Broader range of residential accommodation to be permitted with consent in E2 where previously prohibited in B4/B6 - Tourist and visitor accommodation to be permitted with consent in E1/E2 where previously prohibited in B1/B4/B6 - Broader range of commercial premises to be permitted with consent in E1/E2 where previously prohibited in B1/B6 - Some light industries to be prohibited in E2 where previously permitted with consent in B6 - Broader range of community infrastructure facilities (such as child-care, etc.) to be permitted with consent in E1/E2 where previously prohibited in B1/B6 - Places of public worship to be permitted with consent in E1/E2 where previously prohibited in B1/B4/B6 (this change is mandated) - Outdoor recreation facilities to be permitted with consent in E2 where previously prohibited in B4/B6 |

|

Auburn Town Centre |

B4 Mixed Use lands become E1 Local Centre. |

- Group homes to be permitted with consent where previously prohibited - Places of public worship to be permitted with consent where previously prohibited (this change is mandated) - Outdoor recreation facilities to be permitted with consent where previously prohibited |

|

Granville Town Centre |

B2 Local Centre and B4 Mixed Use lands become E1 Local Centre. |

- Group homes to be permitted with consent where previously prohibited in B4 - Places of public worship to be permitted with consent where previously prohibited in B2/B4 (this change is mandated) - Outdoor recreation facilities to be permitted with consent where previously prohibited in B2/B4 |

|

Lidcombe Town Centre |

B4 Mixed Use lands become E1 Local Centre. |

- Group homes to be permitted with consent where previously prohibited - Places of public worship to be permitted with consent where previously prohibited (this change is mandated) - Outdoor recreation facilities to be permitted with consent where previously prohibited |

|

Guildford Town Centre |

B2 Local Centre and B4 Mixed Use lands become E1 Local Centre. |

- Group homes to be permitted with consent where previously prohibited in B4 - Places of public worship to be permitted with consent where previously prohibited in B2/B4 (this change is mandated) - Outdoor recreation facilities to be permitted with consent where previously prohibited in B2/B4 |

|

Land at St Hilliers Road, Auburn (bordered by A6, Hall St., Percy St.) |

IN1 General Industrial lands become E3 Productivity Support. |

- Broader range of commercial premises to be permitted with consent where previously prohibited - Sex services premises to be prohibited where previously permitted with consent - Health services facilities to be permitted with consent where previously prohibited |

Table 6: Key Changes in Land Use Tables in Areas with Changes in Translation

Mixed use zones

Several centres in the Cumberland are currently entirely or partly zoned B4 Mixed Use under the Cumberland LEP. The Department of Planning and Environment’s proposed translation approach recommends that these zones be transitioned to the new MU1 Mixed Use zone. However, under the Employment Zones Reform Guidelines provided to Council officers, the MU1 Mixed Use zone is intended to be a supporting zone for the edges of centres and not a primary land use classification for town centres.

As such, land in town centres that is currently zoned B4 Mixed Use in the Cumberland LEP is proposed to be changed to the new E1 Local Centre zone instead. This re-classification has been discussed with the Department of Planning and Environment and is considered more appropriate and reflective of the existing function and operation of these lands, as well as being better aligned with strategic policy objectives.

Changes to Cumberland LEP clauses

Council officers have also reviewed local clauses under Part 6 of the Cumberland LEP to ensure consistency with the proposals under the employment zones reform. Minor changes are proposed to two clauses, where changes are required to align with the new employment zoning imposed through the reforms. Further details are provided in Table 7, and Attachments 1 to 4.

|

EXISTING CLEP 2021 CLAUSE |

REFORM CHANGE |

KEY NOTES |

|

Cl. 6.13 Ground floor development in Zones B2 and B4 |

Cl. 6.13 Ground floor development in Zones E1, E2, E3 and MU1 |

- The objective of this clause is to ensure that active uses are provided at the street level in certain business zones to encourage the presence and movement of people - Amend the title to reflect changes to the proposed zoning name from the employment zones reform (e.g. B2 Local Centre to E1 Local Centre, B4 Mixed Use to MU1 Mixed Use and add E2 Commercial Centre and E3 Productivity Support) - Apply cl. 6.13 to the new E2 zone will ensure that the existing provisions will continue to be implemented and meet objectives of cl. 6.13 - Additionally, amend cl. 6.13(3) and (3)(a) to include ‘serviced apartments’ to reinforce the objectives of the 6.13 to support the active uses are provided at the ground floor |

|

Cl.6.16 Development in the Commercial Precinct

(2) Retail premises are permitted with development consent on land to which this clause applies in Zone B6 Enterprise Corridor. |

6.16 (2) Retail premises are permitted with development consent on land to which this clause applies in Zone E3 Productivity Support. |

- This clause permits retail premises in Commercial Precinct as shown on Key Sites Map (zoned B6) - Amend 6.16(2) to update the zoning name for B6 Enterprise Corridor to E3 Productivity Support, to reflect changes to the updated zoning name under the employment lands reform |

Table 7: Changes to Clauses under the Cumberland LEP

Next steps

It is recommended that Council endorse the proposed translation for the employment zones reform, as outlined in this report and through Attachments 1 to 4.

As this initiative is being led by the NSW Government, a self-repealing State Environmental Planning Policy Explanation of Intended Effect (SEPP EIE) will be exhibited by the Department of Planning and Environment in April 2022. The SEPP EIE will outline each council’s proposed LEP amendment to enable the reforms.

Council officers understand that the Department will produce a webpage that landholders can use to identify proposed changes and make submissions. Submissions in their entirety as well as summaries will be shared with councils following exhibition. The Department of Planning and Environment intends for finalisation and amendments of all LEPs to be completed by the end of 2022.

It is also understood that a savings and transition provision will be made which will allow councils to make changes to other documents incrementally, including Development Control Plans, Local Strategic Planning Statements, and other Council documents.

Community Engagement

The Department of Planning and Environment will be leading and managing a state-wide public consultation of the changes resulting from the employment zones reform in April 2022. The Department will also deliver announced plans to build a publicly accessible web platform to allow the public to identify local changes and make submissions.

The exhibition will also be communicated through Council channels to ensure maximum community awareness. All submissions will be reviewed by both the Department and Council.

Policy Implications

Policy implications for Council are limited and mitigated by active engagement and coordination between Council officers and the Department of Planning and Environment. This has enabled the identification of discrepancies and inconsistencies in land use permissibility and desired land use outcomes prior to implementation of the reforms.

Risk Implications

Council was required to complete and submit the proposed Return Translation Detail to the Department of Planning and Environment by 28 January 2022. The DPE required that Council complete the proposed Return Translation Detail on the basis that Council endorsement would occur no later than end March 2022, as public exhibition is scheduled for April 2022. As such, consideration of this matter cannot be deferred or delayed.

Financial Implications

There are no financial implications for Council associated with this report.

CONCLUSION

The employment zones reform initiated by the NSW Government requires an amendment to the Cumberland LEP. This amendment will transition relevant lands in the Cumberland LEP to new employment zone classifications, with some changes to land use tables and affected clauses. It is recommended that Council endorse the proposed translation of planning provision under this reform process.

Attachments

1. Summary of Proposed Changes to Employment Zones in Cumberland City

2. Cumberland Return Translation Detail on Employment Zones Reform

3. Summary of Employment Zones Reform Land Use Matrix

4. Employment Zones Reform Land Use Matrix by Key Zones, Affected Centres and Sites

DOCUMENTS

ASSOCIATED WITH

REPORT C03/22-32

Attachment 1

Summary of Proposed Changes to Employment Zones in Cumberland City

Attachment 2

Cumberland Return Translation Detail on Employment Zones Reform

Attachment 3

Summary of Employment Zones Reform Land Use Matrix

Attachment 4

Employment Zones Reform Land Use Matrix by Key Zones, Affected Centres and Sites

16 March 2022

Item No: C03/22-33

Infrastructure Contributions Reform - Submission to NSW Government

Responsible Division: Environment & Planning

Officer: Director Environment & Planning

File Number: SC708

Community Strategic Plan Goal: A resilient built environment

Summary

The NSW Government is progressing a series of reforms to the infrastructure contributions system, with the stated aim of creating a ‘simple, fair, consistent and clear system for delivering infrastructure to support more homes and jobs across the state’.

Throughout the reform process, the Government has maintained that all Councils will be better off under the proposed new system, particularly higher than average growth Councils such as Cumberland. However, many local Councils across NSW, including Cumberland, share concerns that the reforms will make it increasingly difficult to deliver the quality, quantity, and variety of infrastructure our communities need, and that the reforms will shift the cost burden for the delivery of growth infrastructure from developers to local councils and ratepayers.

This report provides an overview of the key impacts of the reform on Cumberland and seeks Council’s endorsement of a further submission to the NSW Government, outlining key concerns and other feedback in relation to various aspects of the reforms.

|

Recommendation That Council: 1. Note the status of the NSW infrastructure contributions reform, and the efforts undertaken to date in highlighting the implications in delivering infrastructure to support future growth in Cumberland City; 2. Endorse the draft submission on the implications for Cumberland City Council under the NSW Government’s infrastructure contributions reform, as provided in Attachment 1, and forward to the Department of Planning and Environment; and 3. Delegate authority to the General Manager to finalise the draft submission, including minor typographical changes. |

Report

The infrastructure contributions system is an important component of local and regional planning. It is designed to collect contributions from development that supports funding towards growth infrastructure in an area. The system is regulated through Part 7 of the Environmental Planning and Assessment Act and is delivered at a local level through the Cumberland Local Infrastructure Contributions Plan and Voluntary Planning Agreements.

The NSW Government is progressing a series of reforms to the infrastructure contributions system, with the stated aim of creating a ‘simple, fair, consistent and clear system for delivering infrastructure to support more homes and jobs across the state’. The infrastructure contributions reforms seek to implement the NSW Productivity Commissioner’s recommendations on how to improve the current system, which were published in December 2020 and endorsed by the NSW Government in March 2021 (Attachment 2). A roadmap was also released by the NSW Government on the approach to progress the implementation of these reforms, as outlined in Figure 1.

|

COMPLETE |

COMPLETE |

UNDERWAY |

|

Figure 1: NSW Government’s implementation roadmap for the contribution reforms

Throughout the reform process, the NSW Government has maintained that all Councils will be better off under the proposed new infrastructure contributions system, particularly higher than average growth Councils such as Cumberland. However, many local Councils across NSW, including Cumberland, share concerns that the reforms will make it increasingly difficult to deliver the quality, quantity, and variety of infrastructure our communities need, and that the reforms will shift the cost burden for the delivery of growth infrastructure from developers to local councils and ratepayers.

As part of the infrastructure contributions reform process, the NSW Government has prepared a range of reports and draft proposals. These include:

· A report by the Independent Pricing and Regulatory Tribunal (IPART) on the rate peg to include a population growth factor (Attachment 3). Council officers prepared a submission in response to the draft report (Attachment 4). The recommendations of this report have now been implemented by the NSW Government

· A report by the Independent Pricing and Regulatory Tribunal (IPART) on the preparation of an essential works list and standardised benchmark costs for local infrastructure to be applied to all contributions plans (Attachment 5). Council officers prepared a submission in response to the draft report (Attachment 6). The recommendations of this report are still being considered by the NSW Government.

· A package from the Department of Planning and Environment on the new infrastructure contributions system, including a draft regulation, explanatory note on the draft regulation and draft practice notes (Attachments 7 to 9). Council officers prepared a submission in response to the draft package (Attachment 10). The draft regulation and practice note are still being considered by the NSW Government.

Further to these efforts, Council has previously considered the implications of these reforms and has resolved to write to relevant Ministers and organisations to highlight Council’s concerns regarding the infrastructure contributions reform. Council has also been involved with the City of Sydney and other metropolitan Councils in advocating our concerns regarding the infrastructure contributions reform.

Throughout the reform process, the Government has maintained that all Councils will be better off under the proposed new system, particularly higher than - State average growth Councils such as Cumberland. However, many local Councils across NSW, including Cumberland, share concerns that the reforms will make it increasingly difficult to deliver the quality, quantity, and variety of infrastructure our communities need, and that the reforms will shift the cost burden for the delivery of growth infrastructure from developers to local councils and ratepayers.

In February 2022, the Minister for Planning and Homes announced an extension of submissions on the infrastructure contributions reforms until 25 March 2022. This report has been prepared for Council to consider and endorse a further submission on the infrastructure contributions reform and implications for Cumberland City arising from these reforms.

Implications for Cumberland City under the Infrastructure Contributions Reform

Given the scale and complexity of the infrastructure contributions reform, Council officers engaged an expert consultant to carry out independent modelling and analysis on the likely impacts on the Cumberland Local Infrastructure Contributions Plan over the next 20 years (Attachment 11). The modelling indicates that the infrastructure contributions reforms are likely to impact on Cumberland in the following areas.

1. Council would lose $57 million in developer contributions over the next 20 years

1.

Under the proposed infrastructure contributions system, Cumberland is likely to lose an average of $2.85 million in developer contributions each year, or $57 million in total, over the next 20 years. The most significant losses are expected to occur in the first five years (up to $5 million in one year alone) and it will take approximately 10 years to break even, which relies on the population growth factor that is now applied as part of Council rates.

The negative impact on developer contributions is primarily the result of the Government’s proposal to apply the Essential Works List to all contributions plans, and the resultant impacts on 7.11 revenue. Under the reforms, community facilities will be excluded from the Essential Works List from 2025/26, and this may also be extended to indoor recreation and public domain facilities. These items are currently included in the Cumberland Local Infrastructure Contributions Plan, and would result in a gap in funding for Council to support increased demand for new and upgraded facilities as a result of population growth.

2. Council and ratepayers will have to cover the loss in developer contributions

The Government’s proposal to adjust the rate peg to include a population growth factor, may partially compensate for the negative financial impacts associated with the application of the Essential Works List and Benchmark Costs; however, this raises concerns about fairness under the new system.

To compensate for the loss of developer contributions, Council will need to consider alternate funding options for community facilities any other items currently on its capital works program that are excluded from the Essential Works List.

Alternative sources of funding include:

· Internal borrowing (general/rates revenue and pooling of contributions)

· External borrowing (NSW Treasury Corporation or financial institutions)

· Planning agreements with developers (these must be voluntary and there must be a connection between the development and the infrastructure to be funded).

3. The quality, quantity and variety of local growth infrastructure is likely to diminish

It is estimated that approximately 20 per cent of the infrastructure on Cumberland’s capital works program will not be included on the Essential Works List, and will therefore have to be funded by alternative sources or not delivered at all. It is likely that Council will be required to significantly scale back on its capital works program, focusing on very targeted projects, or provide infrastructure to a more basic standard that does not meet community needs or may result in higher maintenance costs.

Draft Submission

Council officers have prepared a further submission for consideration and endorsement by Council, as provided in Attachment 1. The submission reiterates Council’s concerns regarding the infrastructure contributions reform, and includes some of the key findings from the independent modelling and analysis to provide an evidence base for these concerns. The draft submission also covers a range of other items, as summarised in Table 1.

|

Item |

Council Response |

|

Key implications for Cumberland City |

Provides details on the outcomes of the independent modelling and analysis undertaken on behalf of Council regarding the infrastructure contributions reform, including impacts on developer contributions, impacts on Council and ratepayers, and impacts on local infrastructure |

|

Infrastructure contributions reform |

Provides feedback on the proposed changes to the Environmental Planning and Assessment Regulation in response to the Productivity Commissioner’s recommendations. This includes: · early identification of infrastructure needs · addressing high and rising land values · pooling and borrowing · changes to 7.12 plans · public participation on planning agreements · reporting requirements for affordable housing contributions · standardised exemptions · infrastructure contributions and strategic planning and delivery · land use planning · State infrastructure contributions |

|

Essential works list |

Provides feedback on the essential works list, including the exclusion of works currently included in the local infrastructure contributions plan, and implications on exclusion on works in providing growth infrastructure to meet increased demand |

|

Benchmark costs |

Provides feedback on the review of benchmark costs, noting that Council’s analysis indicates that the majority of costings have been significantly underestimated, and implications in providing growth infrastructure to meet increased demand |

Table 1: Items Covered in Draft Submission on Infrastructure Contributions Reform

It is recommended that Council endorse the submission on the infrastructure contributions reform and forward this to the NSW Government through the Department of Planning and Environment.

Community Engagement

The NSW Government has undertaken community engagement as part of the process for the infrastructure contributions reform.

Policy Implications

Policy implications are outlined in the body of this report.

Risk Implications

A final opportunity for Council endorsed submissions has been provided by the NSW Government. The submission will need to be provided by 25 March 2022. If this matter is delayed or deferred at the meeting, there will be no further opportunity to provide a submission under this process.

Financial Implications

There are significant financial implications for Council should the infrastructure contributions reform proceed, as outlined in this report.

CONCLUSION

This report provides an overview of the key impacts of infrastructure contributions reform on Cumberland and seeks Council’s endorsement of a further submission to the NSW Government, outlining key concerns and other feedback in relation to various aspects of the reforms.

Attachments

1. Council Submission to NSW Government on Infrastructure Contributions Reform (confidential)

2. NSW Government Response to Productivity Commission Review into the Infrastructure Contributions System

3. IPART Review of Rate Peg to Include Population Growth - Final Report

4. IPART Review of Rate Peg to Include Population Growth - Council Officer Submission

5. IPART Review of Essential Works List and Benchmark Costs - Draft Report

6. IPART Review of Essential Works List and Benchmark Costs - Council Officer Submission (confidential)

7. Infrastructure Contributions Reform - Draft Regulation

8. Infrastructure Contributions Reform - Draft Regulation Explanatory Note

9. Infrastructure Contributions Reform - Draft Practice Note

10. Infrastructure Contributions Reform - Council Officer Submission (confidential)

11. Independent Modelling and Analysis on Infrastructure Contributions Reform (confidential)

DOCUMENTS

ASSOCIATED WITH

REPORT C03/22-33

Attachment 2

NSW Government Response to Productivity Commission Review into the Infrastructure Contributions System

Attachment 3

IPART Review of Rate Peg to Include Population Growth - Final Report

Attachment 4

IPART Review of Rate Peg to Include Population Growth - Council Officer Submission

Attachment 5

IPART Review of Essential Works List and Benchmark Costs - Draft Report

Attachment 7

Infrastructure Contributions Reform - Draft Regulation

Attachment 8

Infrastructure Contributions Reform - Draft Regulation Explanatory Note

Attachment 9

Infrastructure Contributions Reform - Draft Practice Note

16 March 2022

Item No: C03/22-34

Draft Planning Agreement for 399 Guildford Road, Guildford

Responsible Division: Environment & Planning

Officer: Director Environment & Planning

File Number: DA-2019/395/1

Community Strategic Plan Goal: A resilient built environment

Summary

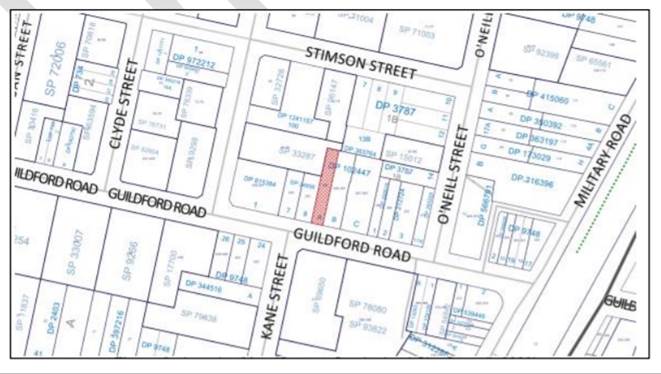

Development Application DA-2019/395/1 was approved by the NSW Land and Environment Court on 20 January 2021 for the construction of a four-storey building comprising two business tenancies and six shop top housing dwellings with basement parking, landscaping, and communal open space. The development was approved with a condition for the applicant to enter into a Planning Agreement for the payment of a monetary contribution to Council in the sum of $75,000 in lieu of 3 commercial vehicle parking spaces that could not be provided on the site due to the site’s constraints.

A draft Planning Agreement has since been prepared in accordance with the condition. Following review by Council’s solicitors and officers, it is recommended that Council endorse the draft Planning Agreement. The proposal is consistent with Council’s Planning Agreements Policy and would provide a public benefit through the future provision and/or upgrading of public, commuter car parking or public transport facilities within the local government area.

|

Recommendation That Council: 1. Endorse the draft Planning Agreement at 399 Guildford Road, Guildford; 2. Exhibit the draft Planning Agreement in accordance with Part 7.5 of the Environmental Planning and Assessment Act 1979; and 3. Authorise the Mayor and General Manager to sign and execute the Planning Agreement after the exhibition period, provided no substantial objections have been made to the planning agreement. |

Report

Context

Development Application DA-2019/395/1 was approved by the NSW Land and Environment Court on 20 January 2021 the construction of a four-storey building comprising two business tenancies and six shop top housing dwellings with basement parking, landscaping, and communal open space. The development was approved with a condition for the applicant to enter into a Planning Agreement for the payment of a monetary contribution to Council in the sum of $75,000 in lieu of 3 commercial vehicle parking spaces that could not be provided on the site due to the site’s constraints. It is noted that the development did not propose any uplift as part of the proposed offer to Council.

Proposed Draft Planning Agreement

The proposed Draft Planning Agreement is for the payment of a monetary contribution in the sum of $75,000 in lieu of 3 commercial vehicle parking spaces that could not be provided on the site. Further details of the draft planning agreement are also provided in Attachment 1.

Council’s solicitors and officers have undertaken a review of the draft planning agreement and are satisfied that it is consistent with Council’s Planning Agreements Policy.

Figure 1 – Proposed development highlighted in red

Public Benefit

The proposed draft planning agreement would provide a public benefit given that the contribution is to be put towards the future provision and/or upgrading of public, commuter car parking or public transport facilities within the local government area. The monetary contribution is payable prior to the release of the construction certificate for the development. The agreement does not exclude the application of Section 7.11 contributions.

Next Steps

Should Council endorse the draft Planning Agreement, the documentation will be publicly notified in accordance with Section 7.5 of the Environmental Planning and Assessment Act 1979. The notification and finalisation of the Planning Agreement shall be undertaken in accordance with Council’s resolution.

Should Council not support the proposed draft Planning Agreement, Development Application DA-2019/395/1 cannot proceed.

Community Engagement

Should the draft Planning Agreement be endorsed by Council, the documentation will be publicly notified in accordance with section 7.5 of the Environmental Planning and Assessment Act 1979 and Council’s Planning Agreements Policy.

Policy Implications

Policy implications are outlined in the body of the report.

Risk Implications

There are minimal risk implications for Council associated with this report.

Financial Implications

Financial implications are outlined in the body of the report.

CONCLUSION

Development Application DA-2019/395/1 was approved by the NSW Land and Environment Court, which includes a condition to enter into a Planning Agreement with Council for the payment of a monetary contribution in the sum of $75,000 in lieu of 3 commercial vehicle parking spaces that could not be provided on the site.

Following review by Council’s solicitors and officers, it is recommended that Council endorse the proposed draft Planning Agreement. The proposal is consistent with Council’s Planning Agreements Policy as it would provide a public benefit through the future provision and/or upgrading of public, commuter car parking or public transport facilities within the local government area.

Attachments

DOCUMENTS

ASSOCIATED WITH

REPORT C03/22-34

Attachment 1

399 Guildford Road, Guildford - Draft Planning Agreement

16 March 2022

Item No: C03/22-35

Audit, Risk and Improvement Committee - Draft Minutes of Meeting Held on 14 February 2022

Responsible Division: General Manager

Officer: Executive Manager General Manager's Unit

File Number: HC-06-03-28

Community Strategic Plan Goal: Transparent and accountable leadership

Summary

This report presents the Minutes of the Audit, Risk and Improvement Committee meeting held on 14 February 2022 for Council’s information.

|

Recommendation That Council receive the Draft Minutes of the Audit, Risk and Improvement Committee meeting held on 14 February 2022. |

Report

Council’s Audit, Risk and Improvement Committee recently held a meeting on 14 February 2022.

The minutes of this meeting will be formally adopted at the next Ordinary Committee meeting being held in May 2022.

Minutes of this meeting are attached for Council’s information.

Community Engagement

There are no consultation processes for Council associated with this report.

Policy Implications

There are no policy implications for Council associated with this report.

Risk Implications

There are no direct risks associated with this report. However, the presentation of the meeting minutes to Council provides transparent oversight of Council activities.

Financial Implications

The operations of the Audit, Risk and Improvement Committee are coordinated by the Corporate Services division of Council utilising existing allocated resources. There are no additional financial implications for Council associated with this report.

CONCLUSION

The minutes of the Audit, Risk and Improvement Committee meeting are provided to Council for information purposes and to ensure that the review mechanisms of Council operate in an open and transparent manner. It is recommended that Council receive this information.

Attachments

1. Draft Minutes of the Audit, Risk and Improvement Committee - 14 February 2022

DOCUMENTS

ASSOCIATED WITH

REPORT C03/22-35

Attachment 1

Draft Minutes of the Audit, Risk and Improvement Committee - 14 February 2022